When Evidence Slays Mythology

Conventional wisdom makes for great dinner conversation, less so for your portfolio

We all love a good myth. They’re thrilling, familiar, and often just believable enough to pass for truth. Vikings with horned helmets, a flat medieval Earth, Nero fiddling as flames engulfed Rome, and perhaps the most delightfully damning of all - Marie Antoinette dismissing the plight of the poor with “let them eat cake.” Entertaining? Absolutely. True? Not quite.

And just like history, investing is riddled with fictions that feel right but fall flat when tested. Let’s shine a light on three of the biggest investing myths, using facts, not folklore, to help you make better decisions.

Myth 1: A weak economy means weak markets

It’s a tidy story: if the economy’s tanking, surely the market must follow. But the world is rarely that linear. The stock market isn’t a thermometer for today’s economy; it’s a forecasting machine. Inputs include anticipated future earnings, investor mood swings, and a hefty dose of discounted expectations. Its job? Price in tomorrow’s potential, not today’s headlines.

Why does that matter? Because markets don’t thrive on results, they thrive on surprises. If investors brace for economic gloom but GDP growth comes in just a bit better than feared - equities rally. That upside surprise fuels optimism, not the base numbers themselves.

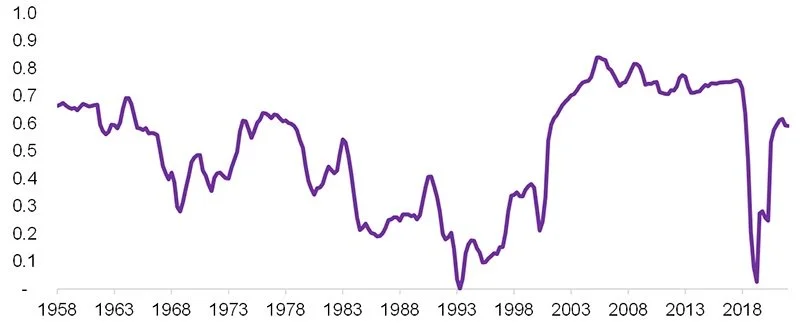

And the long arc of data backs this up. While it’s tempting to believe GDP and market returns walk hand in hand, the data tells a different story. Between 1958 and 1993, that relationship fell from a healthy 0.7 to a flat zero.¹

US Real GDP Growth vs. US Stock Market Returns: 10-Year Rolling Correlations, Since 1958

Sources: Finominal, Kenneth R. French Data Library, St. Louis Fed

Global data from 1988 to 2015 paints an even murkier picture, suggesting that GDP growth and market returns sometimes move inversely.²

Relationship Between GDP Growth and Stock Market Returns (1988-2015)

Source: Morningstar Analysts

Case in point? China. The world’s second-largest economy - rapid growth, tremendous output - yet a striking underperformer on the investment front. Bottom line: economic strength doesn’t always translate into market success. In investing, as in life, context beats certainty.

Myth 2: Investment Managers’ past performance is a guide to future returns

We’ve all been there. Sitting across from a manager proudly showcasing their 1-, 3-, and 5-year returns. Impressive charts, compelling narratives, confident delivery. Surely that kind of track record means something… right?

Unfortunately, not much. Outside of controlled experiments or some individual sports, consistent repeatability in public market investing is elusive. That’s not to say great investors don’t exist - Buffett and Lynch come to mind - but they are the outliers, not the standard.

To separate skill from luck, we must look at the herd, not the hero. And the herd paints a sobering picture. Over the past decade, fewer than 1 in 10 Canadian equity managers beat their benchmark.³ This isn’t much better when we look at global or US equity managers.

Exhibit 1: Percentage of Underperforming Active Canadian Funds

Source: S&P Dow Jones Indices LLC, Fundata. Data as of Dec. 31, 2024. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

Still not convinced? Let’s assume some managers really are skilled. If so, they should consistently outperform. But when we follow top-half performers over two consecutive 5-year periods, their odds of staying on top dip below 50%, worse than a coin flip.⁴

Exhibit 1: Percentage of Funds Repeating in Top Half over Two Consecutive Five-Year Periods

Source: S&P Dow Jones Indices LLC, Fundata Canada Inc. Data as of Dec. 31, 2024. Chart is provided for illustrative purposes. Past performance is no guarantee of future results.

The takeaway? Outperformance in investing behaves more like noise than signal. Luck can mimic talent, but it rarely lasts. If anything, chasing past winners is a surefire way to stay one step behind.

Myth 3: Investing near all-time highs is a recipe for regret

It’s a gut-punch many know too well, buying just before prices drop. That sting of buyer’s remorse leads to a common hesitation: “Markets are at a peak. I’ll wait.”

But the data tells a different story. History tells a different story. One-, three-, and five-year returns following all-time highs are statistically indistinguishable from average returns at any time.

Put differently, buying at a peak has never been a reliable predictor of poor performance.5

In fact, around 30% of all monthly market closes are at or near all-time highs. Why? Because markets rise over time. Highs are not rare, they’re routine. Accepting that makes it much easier to stay the course.

Trying to time the market feels smart. But staying invested, time in the market, is what builds wealth. Your future self won’t care if you bought at a high - only that you invested and stayed the course.

Final Thoughts

Investing myths thrive because they’re intuitive, simple, and emotionally satisfying. But they don’t survive scrutiny. Whether it's the supposed symbiosis between markets and the economy, the allure of a star manager’s track record, or the fear of buying at the top, the data consistently says otherwise.

In the end, investing isn’t about perfect timing or flawless foresight. It’s about humility, patience, and the courage to stick with evidence over anecdotes. That’s how better decisions and better outcomes are made.

In the long run, it's not the loudest myth but the quietest truth that shapes real results.

This information has been prepared by Damir Alnsour, MBA, CFA, CFP®, FCSI® who is Head of Portfolio Management, Portfolio Manager, Financial Planner for Westmount Wealth Management Inc. Westmount Wealth Management Inc. is registered as a Portfolio Manager in British Columbia, Alberta, and Ontario. Westmount Wealth Planning Inc. is a subsidiary of Westmount Wealth Management Inc.

This material is distributed for informational purposes only and is not intended to provide personalized legal, accounting, tax, or specific investment advice. Please speak to a Westmount Wealth Advisor regarding your unique situation.

¹ Rabener, Nicolas. "Myth-Busting: The Economy Drives the Stock Market." CFA Institute Enterprising Investor, March 17, 2023. https://blogs.cfainstitute.org/investor/2023/03/17/myth-busting-the-economy-drives-the-stock-market/

² Bryan, Alex. "Economic Growth: Great for Everyone but Investors?" Morningstar, October 19, 2016. https://www.morningstar.com/funds/economic-growth-great-everyone-investors.

³ S&P Dow Jones Indices. 2025. "SPIVA Canada Year-End 2024 Scorecard." March. S&P Global. https://www.spglobal.com/spdji/en/documents/spiva/spiva-canada-year-end-2024.pdf

⁴ S&P Dow Jones Indices. "Canada Persistence Scorecard: Year-End 2024." S&P Global. May 15, 2025. https://www.spglobal.com/spdji/en/spiva/article/canada-persistence-scorecard/

⁵ Source: Dimensional Fund Advisors. “Why a Stock Peak Isn’t a Cliff.” In USD. For illustrative purposes only. New market highs are defined as months ending with the market above all previous levels for the sample period. Annualized compound returns are computed for the relevant time periods subsequent to new market highs and averaged across all new market highs observations. There were 1,163 observation months in the sample. January 1926 -December 1989: S&P 500 Index; Stocks, Bonds, Bills and Inflation Yearbook®, Ibbotson Associates, Chicago. January 1990 -Present: S&P 500 Index (total return), S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.