Nothing Works All the Time, But Some Things Never Change

If markets teach us anything, it’s humility. The moment we believe we’ve found a formula that always works, the landscape shifts. Every decade crowns a new “sure thing”, and every decade reminds us that certainty is an illusion.

At Westmount Wealth Management, we often repeat one simple truth: Nothing works all the time, but some things never change. The first part grounds us in reality. The second part reminds us where to anchor.

The Rhythm of Markets

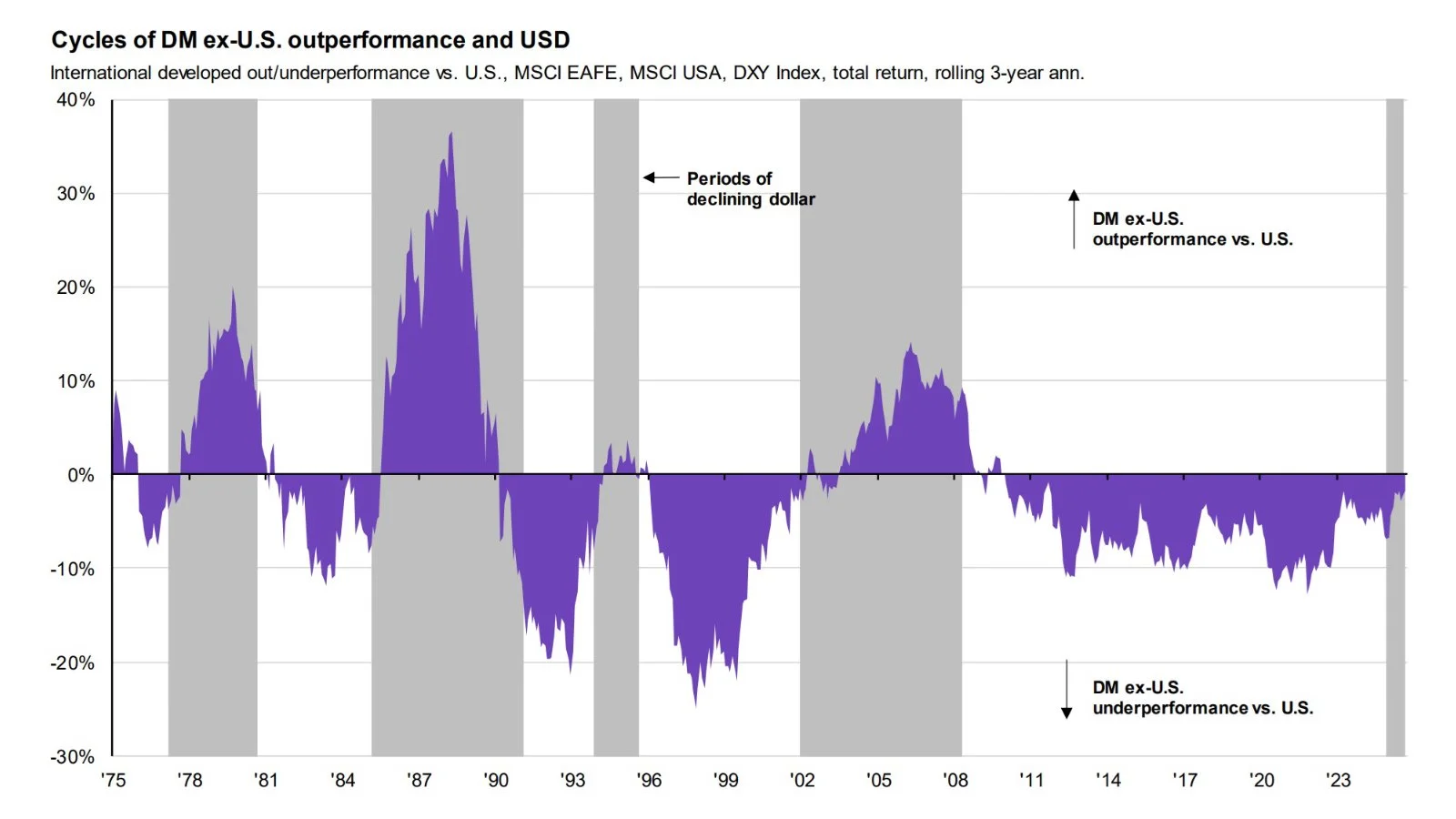

Investing is a parade of cycles: styles, sectors, asset classes, and stories rotating through the spotlight. Diversification is the classic example. Everyone believes in it until it starts to feel unrewarding. In a balanced portfolio, something is always lagging. When U.S. equities dominate, your international allocation feels like dead weight, as experienced over the past 15 years.

Source: J.P. Morgan Asset Management. 2025 Q4. Guide to the Markets

When interest rates rise, bonds lose their protective shine. Small caps often surge in recoveries, then trail in slowdowns. If every part of your portfolio is “working,” you’re likely taking more risk than you realize.

The same rhythm plays out in the long tug-of-war between value and growth investing. Historically, value stocks - those trading at lower prices relative to earnings or book value - have outperformed growth stocks by roughly 3–4% annually over long horizons¹. Yet markets move in cycles. During the 2010s, growth dominated, beating value by nearly 8% per year². Then, as inflation and rates rose after 2022, value made its comeback. Both sides take turns looking brilliant and broken. The discipline lies not in guessing the next winner, but in enduring the seasons when your style is out of favor.

Source: J.P. Morgan Asset Management. 2025 Q4. Guide to the Markets

Market timing tells a similar story. The idea of stepping aside before storms and jumping back in before recoveries is seductive, and almost impossible. Missing just the twenty-five best trading days in the S&P 500 over a twenty-year span has historically cut total returns by more than half³. The irony: those best days usually occur within weeks of the worst ones⁴. The market’s rewards belong not to the precise, but to the patient.

Source: Dimensional Fund Advisors. “Investment Principles for Navigating Volatility.”

Even professional investors fall into the pattern. A fund that shines for years draws headlines and assets, only to cool once its tailwinds fade. The rapid rise and fall of the ARK Innovation ETF is a recent example. Momentum can attract attention, although mean reversion never retires.

And then there are the supposed inflation hedges and “safe havens.” Gold, real estate, and inflation-linked bonds all have their moments and their long slumps. Gold surged after the 2008 crisis, only to stagnate through much of the 2010s⁵. Real estate boomed through the low-rate years, then cooled as borrowing costs climbed. Even cash, comforting as it feels, can quietly erode purchasing power when inflation picks up. In a higher rate environment, cash earns again, which is a reminder that even safety has its own cycle.

The Things That Never Change

If the moving parts test our discipline, the constants remind us why the effort is worth it.

Spend less than you earn. The first law of wealth creation. Without surplus, compounding cannot begin. It’s not flashy advice - but it’s undefeated.

Time in the market beats timing the market. Compounding is exponential. Missing even a handful of good days can cripple returns. Over the past two decades, an investor fully invested in the S&P 500 would have earned about 9.8% annually, but missing just the ten best days drops that to 5.6%⁶.

Diversify broadly and globally. Every generation thinks its home market is safest, until it isn’t. Japan’s Nikkei peaked in 1989 and took more than three decades to recover in local terms. Global diversification doesn’t guarantee brilliance, but it protects against regret.

Control what you can control. Savings rate, fees, taxes, and time horizon matter far more than forecasts. Compounding works both ways, costs and taxes compound against you.

Rebalance periodically. Selling what’s done well to buy what’s lagged feels uncomfortable - which is why it works. Rebalancing enforces discipline without requiring prediction.

Stay humble and patient. No one, not even the most seasoned investor, knows what happens next. The antidote to uncertainty isn’t prediction; it’s process.

Match your strategy to your goals and behavior. The best portfolio isn’t the one with the highest returns; it’s the one you can live with, the one you understand.

Simplicity beats complexity. The financial industry evolves, covered call strategies, crypto derivatives, AI-driven ETFs - but clarity and transparency remain timeless advantages.

Human nature never changes. Fear, greed, envy, and impatience have driven every boom and bust in history. Recognizing those impulses, and building a plan resilient enough to withstand them, is the real edge.

Bridging the Moving Parts and the Timeless Principles

If “nothing works all the time” reminds us to expect change, “some things never change” reminds us where to anchor.

Asset classes rotate leadership - but global diversification endures.

Styles take turns winning - but discipline and rebalancing remain reliable.

Market timing fails - but steady savings and patience succeed.

Star managers fade - but low costs and tax efficiency compound.

Cash feels safe until inflation bites - but thoughtful liquidity planning endures.

In investing, permanence lives in principles rather than products. Markets will always find new ways to challenge investors. The solutions are older than any trend.

Patience. Discipline. Perspective.

These fundamentals continue working even when markets do not cooperate in the short run.

At Westmount Wealth Management, lasting wealth is not created by chasing the next big thing. It is created by applying timeless principles with care, clarity and consistency.

Our role is to help you navigate changing markets with a steady process that is grounded in data and aligned with your goals. And although nothing works all the time, the fundamentals of thoughtful investing never stop working.